Fascination About Fortitude Financial Group

Fascination About Fortitude Financial Group

Blog Article

The 30-Second Trick For Fortitude Financial Group

Table of ContentsThe Single Strategy To Use For Fortitude Financial GroupThe Single Strategy To Use For Fortitude Financial GroupThe 10-Second Trick For Fortitude Financial GroupThe 10-Second Trick For Fortitude Financial Group

With the appropriate plan in position, your money can go better to assist the organizations whose missions are lined up with your worths. An economic consultant can aid you define your philanthropic providing objectives and integrate them right into your monetary plan. They can also advise you in ideal ways to maximize your giving and tax deductions.If your business is a collaboration, you will desire to go with the succession planning procedure with each other - St. Petersburg, FL, Financial Advising Service. A financial advisor can assist you and your partners recognize the vital elements in service succession preparation, identify the value of business, develop shareholder contracts, establish a compensation framework for followers, outline shift options, and much a lot more

The key is discovering the ideal financial consultant for your situation; you might end up engaging different experts at different phases of your life. Try calling your economic institution for suggestions.

Your following step is to speak to a certified, accredited specialist that can supply guidance customized to your specific circumstances. Nothing in this short article, nor in any connected sources, need to be understood as monetary or legal guidance. While we have actually made excellent faith efforts to guarantee that the information offered was proper as of the date the content was prepared, we are unable to guarantee that it continues to be exact today.

The Facts About Fortitude Financial Group Revealed

Financial consultants assist you make decisions regarding what to do with your money. Let's take a more detailed look at what precisely an economic advisor does.

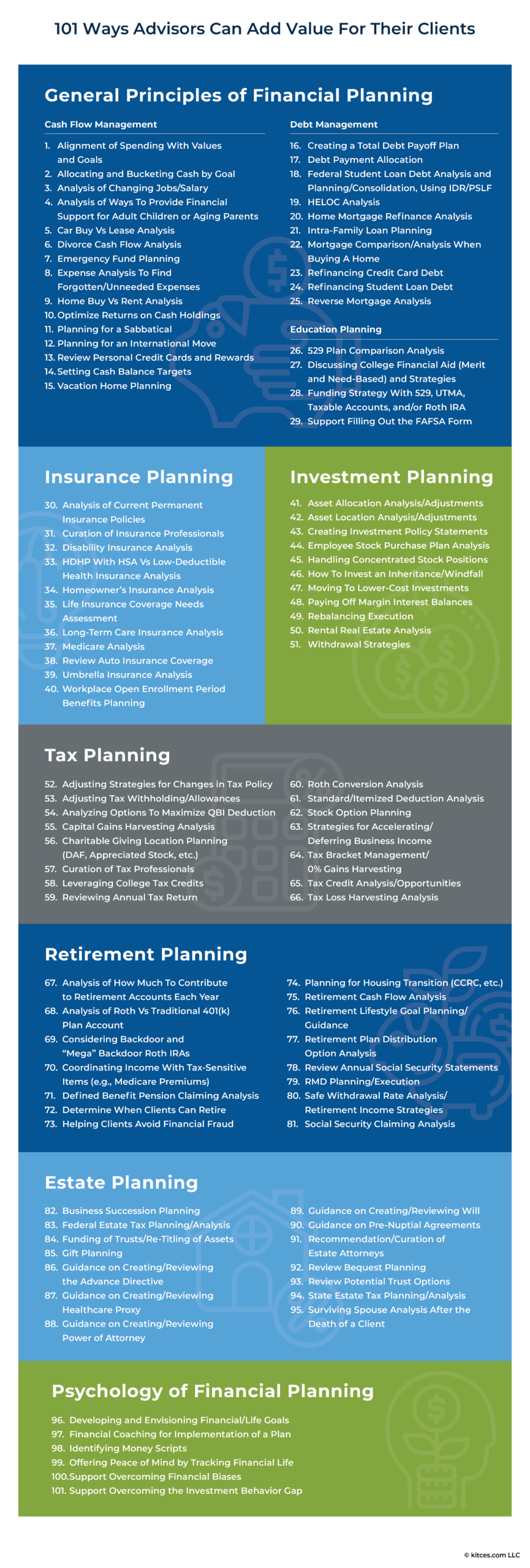

Advisors utilize their understanding and expertise to create individualized financial strategies that aim to accomplish the financial goals of customers (https://fortitudefg1.blog.ss-blog.jp/2024-08-26?1724680362). These plans include not just investments yet also savings, spending plan, insurance policy, and tax methods. Advisors further sign in with their clients often to re-evaluate their current circumstance and strategy accordingly

How Fortitude Financial Group can Save You Time, Stress, and Money.

To accomplish your goals, you may require an experienced expert with the ideal licenses to assist make these plans a fact; this is where an economic expert comes in. With each other, you and your consultant will cover numerous topics, consisting of the quantity of money you need to conserve, the types of accounts you need, the kinds of insurance you need to have (consisting of lasting treatment, term life, handicap, etc), and estate and tax planning.

Financial experts give a range of solutions to customers, whether that's offering trustworthy general financial investment recommendations or helping within an economic goal like purchasing a college education fund. Listed below, discover a checklist of one of the most usual services provided by financial advisors.: A monetary advisor uses suggestions on financial investments that fit your style, objectives, and danger resistance, developing and adjusting investing approach as needed.: A monetary advisor develops approaches to assist you pay your financial obligation and prevent debt in the future.: An economic consultant offers tips and methods to produce spending plans that assist you meet your objectives in the short and the lengthy term.: Part of a budgeting method may consist of approaches that help you pay for greater education.: Also, an economic consultant creates a conserving plan crafted to your certain needs as you head into retirement. https://blogfreely.net/fortitudefg1/html-lang-en.: A monetary consultant helps you determine individuals or companies you wish to obtain your heritage after you die and develops a plan to accomplish your wishes.: An economic consultant offers you with the most effective long-term options and insurance coverage options that fit your budget.: When it pertains to tax obligations, an economic advisor might assist you prepare income tax return, maximize tax reductions so you obtain the most out of the system, timetable tax-loss harvesting safety sales, guarantee the ideal use the capital gains tax rates, or plan to reduce taxes in retirement

On the survey, you will certainly additionally show future pension plans and revenue resources, project useful link retired life needs, and describe any kind of long-term financial responsibilities. Basically, you'll provide all existing and predicted financial investments, pensions, gifts, and incomes. The investing part of the questionnaire touches upon even more subjective topics, such as your danger tolerance and danger ability.

The Only Guide for Fortitude Financial Group

At this factor, you'll also allow your consultant know your investment choices. The first assessment might likewise include an assessment of various other economic administration subjects, such as insurance policy issues and your tax situation.

Report this page